Why Credit Card Defaults Are Surging - From Poor to Rich

What the Data Says

If your wallet feels tighter lately, you're definitely not alone. Across the U.S., an unsettling financial trend has taken hold: a growing number of Americans are falling behind on their credit card payments. The latest reports, including a particularly insightful analysis from the St. Louis Fed, reveal just how serious this issue has become. By early 2025, what initially looked like a minor uptick has turned into a widespread economic stress signal, demanding our attention.

My work involves algorithm design and improvement, and recently, we've received multiple requests to help enhance credit modeling and fraud detection systems. This uptick in interest piqued my curiosity, leading me to dive deeper into the current rise in credit card delinquencies. Here's some of the background research that informs my perspective.

The Numbers

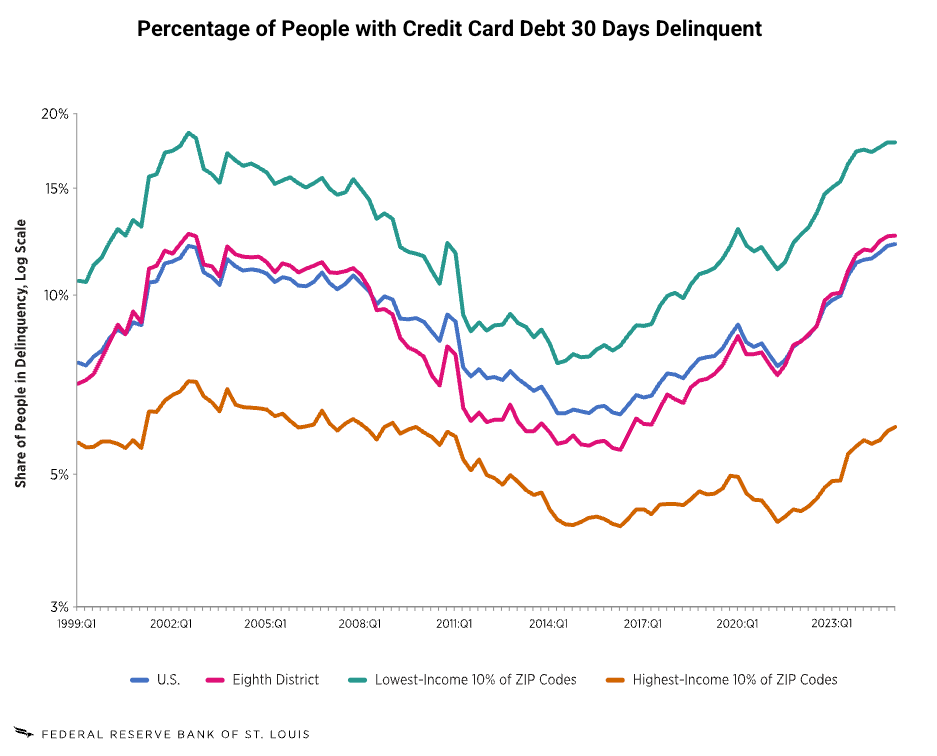

Since early 2021, credit card delinquency rates—accounts overdue by 30 days or more—have steadily climbed for ten straight quarters. While early 2025 saw a slight slowdown in this upward momentum, the situation remains troubling.

Here's an unexpected twist: it’s not just lower-income households feeling the squeeze. Wealthier ZIP codes, traditionally insulated from such issues, have seen dramatic proportional increases in delinquent debt. Between the second quarter of 2022 and the first quarter of 2025, the share of credit card debt 30 days or more past due in the highest-income 10% of ZIP codes surged from 4.8% to 8.3%—a striking 73% relative increase. By comparison, the lowest-income 10% of ZIP codes experienced a rise from 14.9% to 22.8%, marking a 53% relative increase. This trend is even sharper for serious delinquencies (90 days or more overdue), where rates in the highest-income ZIP codes jumped from 4.1% to 7.3%, an 80% relative increase, compared to a 59% rise in the lowest-income areas. Between mid-2022 and early 2025, delinquent balances in the highest-income ZIP codes surged by a staggering 73%, an increase even sharper than in lower-income areas.

Perhaps most concerning is the spike in serious delinquencies—accounts overdue by 90 days or more. By Q1 2025, this serious delinquency rate reached 12.3%, echoing troubling levels not witnessed since the aftermath of the 2008 financial crisis. Young Americans, especially those under 30, are particularly hard-hit, with their serious delinquency rate climbing to 10.3%.

Although total credit card balances dipped slightly to $1.18 trillion in early 2025, they still remain significantly elevated compared to previous years. The critical takeaway? Today's delinquency rates are rapidly approaching—or even surpassing—levels last seen during the darkest days of the Global Financial Crisis.

Why Now?

This troubling trend doesn't have a singular root cause; it's more like a convergence of multiple financial storms:

Inflation’s Persistent Pressure: Sustained inflation has drained household budgets, pushing more families to rely on credit cards to cover essentials such as groceries, fuel, and rent.

Interest Rates Soaring: The Federal Reserve’s aggressive rate hikes, designed to combat inflation, have directly translated into higher APRs, quickly turning manageable balances into financial nightmares.

Interestingly, this financial squeeze isn't limited to lower-income households. High-income groups, typically insulated from economic downturns, are increasingly feeling the pinch—a notable departure from previous crises. Several factors are contributing to this phenomenon:Depletion of Pandemic Savings: Many high-income households have exhausted the significant savings accumulated during the pandemic, eliminating a financial buffer that previously helped absorb rising costs.

Lifestyle Inflation and Fixed Expenses: Wealthier households often maintain high fixed costs like large mortgages, private schooling, and luxury leases. Persistent inflation and rising interest rates make maintaining these lifestyles more challenging, pushing many into greater reliance on credit.

Higher Credit Utilization: Data indicates wealthier consumers are using more of their available credit, leading to elevated balances and higher delinquency risk.

Psychological Spending: Some high-income individuals are engaging in "doom spending," increased expenditures as a coping mechanism against economic uncertainty, further eroding their financial stability.

These unique pressures on higher-income households mark a significant shift from past economic downturns, where financial distress typically concentrated in lower-income groups.- Increasing Reliance on Credit: More Americans aren’t just using credit cards frequently; they're also carrying larger balances month-to-month. The proportion making only minimum payments hit a 12-year high at the end of 2024—a clear signal of widespread financial stress.

Generational Strains: Millennials and younger consumers have surpassed pre-pandemic delinquency rates faster than any other group, indicating disproportionate financial strain.

Multiple Debts Piling Up: With student loan payments resuming and auto loan pressures mounting, consumers juggling multiple debts find themselves increasingly stretched thin.

High Credit Utilization: Consumers using most of their available credit are transitioning into delinquency at alarming rates, a red flag signaling deeper financial distress.

How Does This Compare to Past Crises?

While the rising delinquencies inevitably remind us of the 2008 crisis, today's situation is uniquely different:

The Pandemic’s Aftermath: Unlike 2008, driven largely by massive job losses, the current crisis is unfolding amidst a relatively robust job market. Pandemic-era financial support reduced delinquencies dramatically—but as these supports expired, households faced debt accumulation compounded by relentless inflation.

Unprecedented Inflationary Pressure: Unlike typical recessions, today's rapid and sustained price increases for daily essentials have led to a more urgent dependence on credit cards, altering traditional spending behaviors.

Rapid Interest Rate Hikes: The swift move from historically low interest rates to persistent rate hikes is unusual compared to previous downturns, rapidly intensifying the financial burdens for consumers.

Changing Consumer Habits: After the pandemic, more Americans began "revolving" balances month-to-month, reflecting a shift from cautious credit use to heavy reliance, another sign of deepening financial strain.

What’s Next? Rethinking Credit Risk Modeling

This new environment exposes significant shortcomings in traditional credit risk modeling, which relies heavily on historical patterns and stable economic indicators. Today's complex dynamics demand innovative analytical approaches, leveraging real-time data, predictive modeling, and alternative indicators such as spending habits and digital footprints.