The Rise and Rise of Small Modular Nuclear Reactors

Hype, Dreams, Economics, and Uncertainty Fueling the Nuclear Renaissance in a Data Center World

Nuclear power is having its moment —and here we are, writing long articles again. In recent months, we’ve been bombarded with news about small modular reactors (SMRs) revolutionizing energy for data centers. We’ve been analyzing and reflecting on this trend for a while. Here, we aim to cut through the noise and share our perspective on the nuclear renaissance. We’ll explore the allure of SMRs for AI-driven data centers, discuss our insights on the NRC approval process, and examine the economics and uncertainties of the current nuclear power supply and demand.

1. Why Data Centers Are Looking to SMRs

The AI boom and rapid expansion of data centers have intensified energy demand, prompting interest in small modular reactors (SMRs) as a viable power source. Unlike traditional nuclear reactors, SMRs are smaller and modular, allowing for phased construction that aligns with growing energy needs. This modularity enables data centers to "plug in" additional nuclear modules as required, ensuring consistent power supply for high-performance computing.

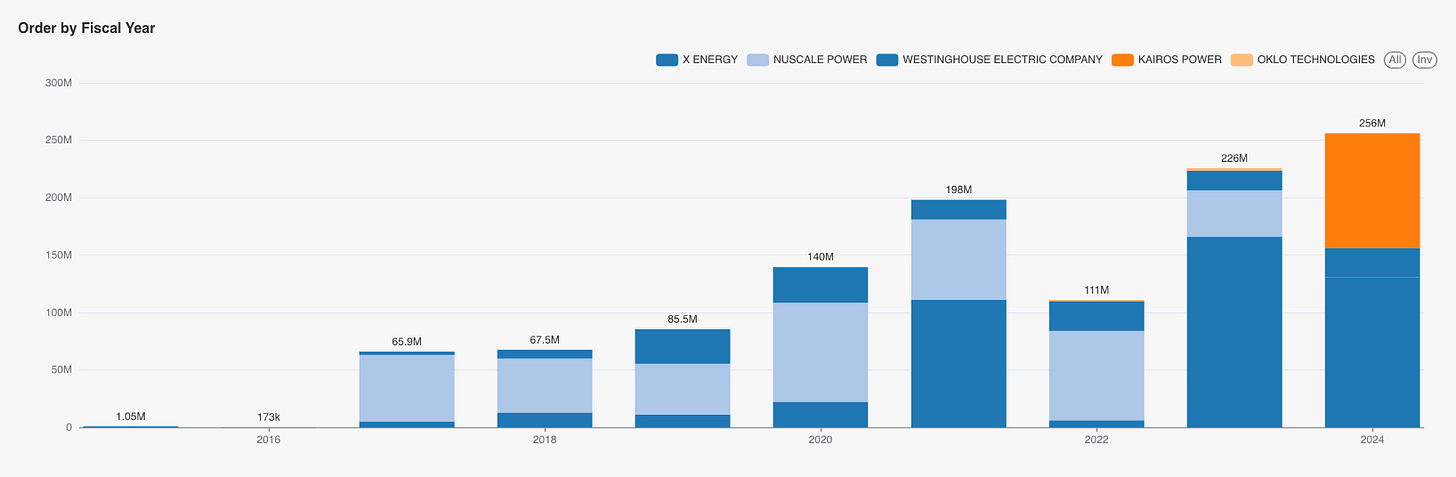

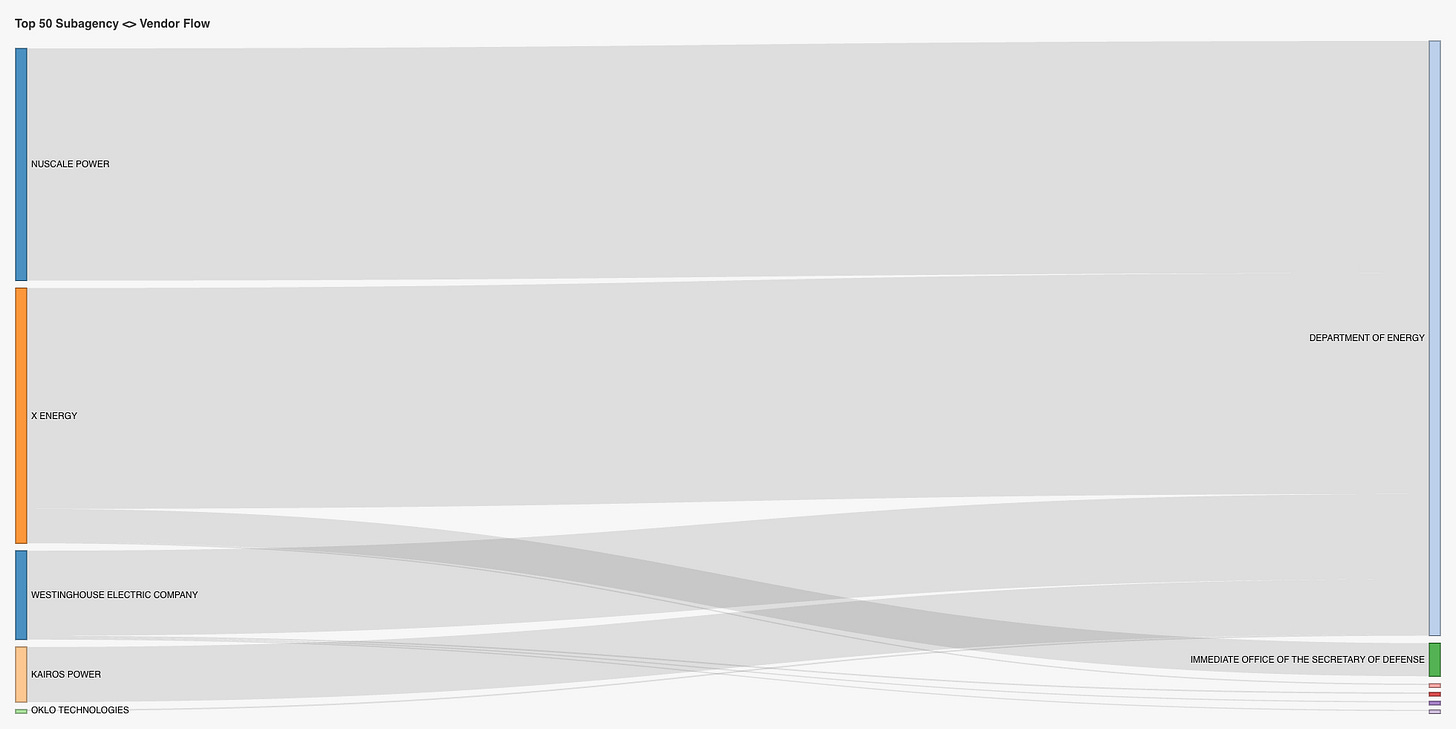

Companies like Kairos Power and X-Energy have garnered attention from hyperscalers such as Google and AWS, which have announced partnerships to explore nuclear energy solutions. Microsoft is also involved in the nuclear sector, seeking to restart existing reactors. While many of these initiatives are still in early stages, they indicate a significant shift in the tech industry's approach to energy, suggesting that nuclear power could become integral to data center operations alongside other technologies.

We’re all for clean, safe alternative energy, but a reality check is in order. Despite the enthusiasm for SMRs, challenges remain, particularly in regulatory approval processes. The complexities of U.S. nuclear regulations mean that while the potential for SMRs is promising, their path to widespread deployment is fraught with technical and bureaucratic hurdles. So, if any VC-funded startup tells you NRC approval is a breeze, proceed at your own risk.

2. New Faces of Nuclear

Small Modular Reactors (SMRs) signify a significant evolution in nuclear energy, moving away from large, costly reactors. Typically producing 50 to 300 megawatts of power (vs. traditional large-scale nuclear reactors, which often generate over 1,000 MWe), SMRs feature a modular design that allows for phased construction tailored to specific needs, such as powering data centers or remote communities. Many SMRs utilize alternative cooling methods, like fluoride salt or sodium, which operate at lower pressures, enhancing safety and reducing construction costs and regulatory complexities.

The growing energy demands from AI-driven data centers make SMRs an attractive solution for reliable, decentralized power. Their modularity allows for incremental deployment, enabling additional units to be added as needed without overhauling existing systems. Economically, SMRs offer lower upfront costs and flexible deployment options, appealing to rapidly expanding data centers.

Regulatory advantages also favor SMRs; their smaller size and safety features simplify the approval process compared to traditional reactors. In the U.S., the Nuclear Regulatory Commission (NRC) has developed streamlined pathways for SMR approvals, such as the combined licensing process, hinting at a future where these reactors could become integral to data center operations.

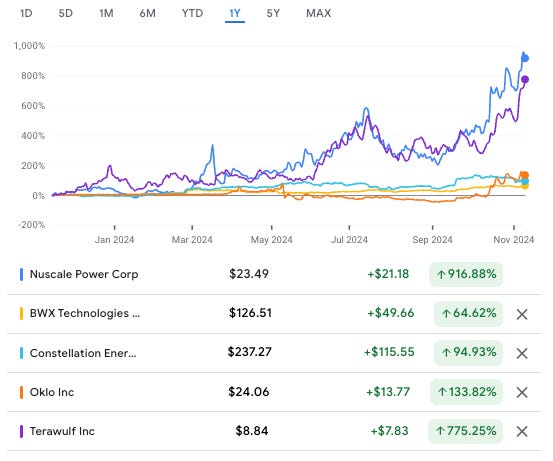

Recent interest in nuclear energy is driven by high-profile partnerships aimed at meeting the increasing power demands of data centers. For instance, Microsoft has signed a 20-year agreement with Constellation Energy to source power from a restarted reactor at Three Mile Island. Additionally, Microsoft has a power purchase agreement with fusion company Helion and is involved with nuclear startup Oklo, which is chaired by Sam Altman and went public via SPAC this May. Google has also made headlines with its groundbreaking agreement with Kairos Power to source power from multiple SMRs for AI applications, aiming to bring the first unit online by 2030.

Despite these promising developments, ambitious projects face scrutiny and regulatory challenges. Following a recent regulatory rejection, Amazon’s partnership with Talen Energy to supply nuclear power to its data centers faces new obstacles, with utilities voicing concerns about possible cost burdens on consumers. Nevertheless, the tech industry's support has reignited interest in modular nuclear power, significantly boosting related stock prices as investors recognize its potential to support the next wave of AI-driven infrastructure. Well, some of these have become meme stocks, driven more by viral social media sentiment than by fundamental value.

3. The NRC Maze: Why Nuclear Approval Isn’t Just a Walk in the Park

Two of us at Procure.FYI have spent a combined 10 years working in international energy regulation and federal technology contracting—it’s what we love. So if it is tedious, bear with us.

The U.S. Nuclear Regulatory Commission (NRC) plays a crucial role in ensuring that nuclear technologies meet stringent safety, environmental, and technical standards. Established in 1974 as the successor to the Atomic Energy Commission (AEC), the NRC's mission is to protect public health and safety through a comprehensive regulatory framework. Its standards are particularly rigorous; each step of the licensing process requires detailed technical documentation, comprehensive safety analyses, and strict environmental compliance, making approval challenging for any nuclear company, especially those introducing new reactor designs. While the FDA and FAA are known for intense regulatory processes, people in the field will tell you that the NRC is like the “FDA and FAA on steroids”, for obvious reasons.

The NRC offers several types of licenses to accommodate different reactor designs and development stages. Here’s a quick rundown of each, so the next time a company says it has a “permit” or “license,” you’ll know exactly what that means:

Construction Permits: This permit authorizes the initial construction of a nuclear facility. It is foundational but does not allow reactor operation once construction is complete.

Operating Licenses: Required after construction to begin operation, granted only after the NRC verifies that the reactor meets all operational safety standards. Currently, no SMR has completed the full licensing process to obtain an operating license.

Combined Licenses (COLs): A streamlined option that authorizes both construction and operation. The NRC typically reserves COLs for designs with substantial safety data and proven operational records, making them challenging for new technologies.

Early Site Permits (ESPs): Allows companies to secure and prepare a site for future nuclear facilities without committing to immediate construction or operation. It’s a strategic move to reserve locations before starting a full-scale project.

Test Reactor Licenses: Issued for reactors primarily used for research and development rather than commercial power generation. Test reactors help refine new technologies before they are scaled up for commercial use.

Manufacturing Licenses (less common): Authorizes the construction of certain reactor components offsite. This allows companies to build standard parts in a factory environment, potentially improving construction efficiency and quality control. While not frequently sought, a manufacturing license can streamline production for modular reactors.

Standard Design Approvals (SDAs) and Standard Design Certifications (SDCs):

SDAs: Certify that a reactor’s design meets NRC safety standards, but they don’t authorize construction or operation. SDAs are typically used to demonstrate a design’s compliance and can simplify future licensing applications.

SDCs: A formal certification process that “freezes” a reactor design, ensuring that no further design changes are required for safety compliance. This certification simplifies the path for future combined license (COL) applications as it locks in an approved design.

4. A Tale of Two SMR Applications

Oklo’s Failed Attempt at NRC COLA Approval in 2022

Oklo, chaired by Sam Altman - ahem , faced a challenging journey through the NRC process, illustrating the complexities and hurdles startups encounter in obtaining nuclear certification, especially when lacking regulatory experience and comprehensive technical documentation. In 2022, Oklo applied for a combined operating license application (COLA), aiming to streamline both construction and operational approvals for their advanced microreactor. Although potentially efficient, this approach demands an exceptionally detailed and well-supported application, which proved challenging for Oklo. The NRC requires applicants to submit extensive safety analyses, technical specifications, and comprehensive data on each stage of reactor design and operations—levels of detail that Oklo’s application ultimately did not meet.

Several key factors contributed to Oklo’s application being denied, underscoring the demanding nature of NRC requirements:

Insufficient Safety Analysis: The NRC found that Oklo's application lacked adequate safety measures for their novel microreactor design, requiring extensive proof of safe operation under various conditions.

Delayed Responses to Requests for Additional Information (RAIs): Oklo struggled to respond fully and promptly to RAIs due to limited staffing and regulatory experience, jeopardizing their application.

Lack of Regulatory Preparation: Without a dedicated regulatory team or comprehensive documentation, Oklo was unprepared for the NRC’s stringent requirements.

Beyond the official reasons for rejection, industry observers raised additional concerns about Oklo’s approach. Oklo’s emphasis on Silicon Valley-style marketing appeared to overshadow substantive nuclear engineering, with limited technical details available beyond PR content. Missed RAI deadlines added to doubts about the company’s readiness and commitment to meeting regulatory demands. Furthermore, Oklo’s use of unconventional heat pipes and other untested methodologies raised skepticism, as the NRC required thorough justifications and extensive testing data for such novel systems—requirements Oklo did not fully meet. Following the rejection, Oklo shifted its focus to fuel recycling technology, but many viewed this pivot as lacking in transparency and concrete progress.

Kairos Power’s Path to NRC Approval in 2023: First Non-Water-Cooled Reactor Permit in Over 50 Years

In contrast, Kairos Power successfully secured an NRC construction permit in 2023 for its Hermes test reactor—a groundbreaking achievement for advanced nuclear technologies in the U.S. The Hermes reactor, a fluoride salt-cooled high-temperature reactor (KP-FHR) utilizing TRISO fuel in pebble form, represents a significant regulatory milestone. Not only is it the first non-light-water reactor construction permit issued by the NRC since its establishment in 1974, but it also sets a precedent for licensing advanced reactor designs. For more insights, there’s an excellent interview with the team members involved in the Hermes project available.

Kairos’s approach offers valuable insights into how strategic preparation and iterative development can facilitate the NRC licensing process, especially for novel technologies:

Site Selection: Kairos chose the Clinch River site, a DOE legacy location with existing infrastructure and completed environmental studies. By using a DOE-regulated site with pre-existing frameworks for compliance and emergency response, Kairos bypassed significant foundational hurdles and focused on developing the technical aspects of Hermes. This allowed them to streamline their NRC application by concentrating on reactor safety, quality, and performance.

Material Choices: Kairos selected fluoride salt as the coolant—a well-studied, reliable material in contrast to more experimental options—and TRISO fuel, a DOE-tested and qualified fuel. These choices reduced regulatory uncertainty by aligning with materials well understood by the NRC, minimizing technical risks that could complicate approval.

Incremental “Design-Build-Test” Development: Inspired by SpaceX, Kairos adopted a staged “design-build-test” model, building non-nuclear platforms to test key systems. This approach allowed them to gather data, address technical challenges, and refine Hermes’s design before submitting their construction permit application, ensuring the NRC received a robust application ready for scrutiny.

RAI Management: To expedite responses to Requests for Additional Information (RAIs), Kairos collaborated with the NRC to create an electronic reading room, enabling both parties to access documents quickly. This proactive system allowed Kairos to respond to RAIs in days rather than the typical 30–60 days, accelerating the review process and demonstrating their commitment to transparency and regulatory compliance.

Disciplined, Phased Growth: Kairos took a measured approach, setting realistic goals before advancing, which aligned well with regulatory expectations. This discipline reduced perceived risks for investors and the NRC. After securing the Hermes permit in a record 18 months, Kairos is now advancing to Hermes II, a larger version with electricity generation capabilities, and is expected to move through the NRC process even more efficiently due to the foundation laid by Hermes.

Through a combination of strategic foresight, careful material selection, collaborative regulatory engagement, and a progressive development model, Kairos Power’s Hermes project provides a playbook for navigating the NRC’s complex regulatory landscape successfully.

5. Key Small Modular Developers and Their Progress in the Licensing Process

We have talked a lot about NRC and contracts and different SMRs. Let's compare the major companies we are assessing here and where they are in the approval process. I’m not including Westinghouse, BWXT, X-energy, or Radiant here, as these companies are either more established nuclear industry players or focused on micro-reactors. We’re focusing on four SMR companies — NuScale, Kairos Power, Oklo, and TerraPower—because they represent emerging, innovative approaches to nuclear power that align with recent demand from hyperscale data centers.

• Status: Public (NYSE: SMR)

• NRC License: Standard Design Approval – NuScale’s small modular reactor (SMR) design received Standard Design Approval from the NRC, validating the design but not authorizing construction or operation.

• Technology Context: NuScale’s design uses established PWR technology, with a modular structure allowing incremental power increases through additional modules. This approach aligns with existing regulatory frameworks.

• Technology: Pressurized Water Reactor (PWR)-based SMR

• Coolant: Pressurized Water

• Output: Updated to 77 MWe per module, with the capability to scale up to 924 MWe in a 12-module plant.

• Pros:

Proven Coolant Technology: Familiar water coolant with extensive operational data.

Modular Construction: Scalable design enabling flexible power deployment.

Regulatory Familiarity: Established protocols and safety standards may expedite approvals.

• Cons:

High-Pressure Design: Pressurization requires reinforced structures, raising construction costs.

Thermal Efficiency Limitations: Water cooling limits operational temperature.

Cost Complexity: The need for high-pressure systems complicates cost reductions, making competitiveness with natural gas challenging.

• Status: Private

• NRC License: Construction Permit – Kairos received a construction permit for its 35 MW (thermal) Hermes demonstration reactor in December 2023. This permit allows construction but not operation, marking the first of a two-step licensing process. Kairos will need an operating license before the reactor can operate.

Additional Application: Kairos also submitted a construction permit application for Hermes 2, a proposed two-unit demonstration plant, currently under NRC review.

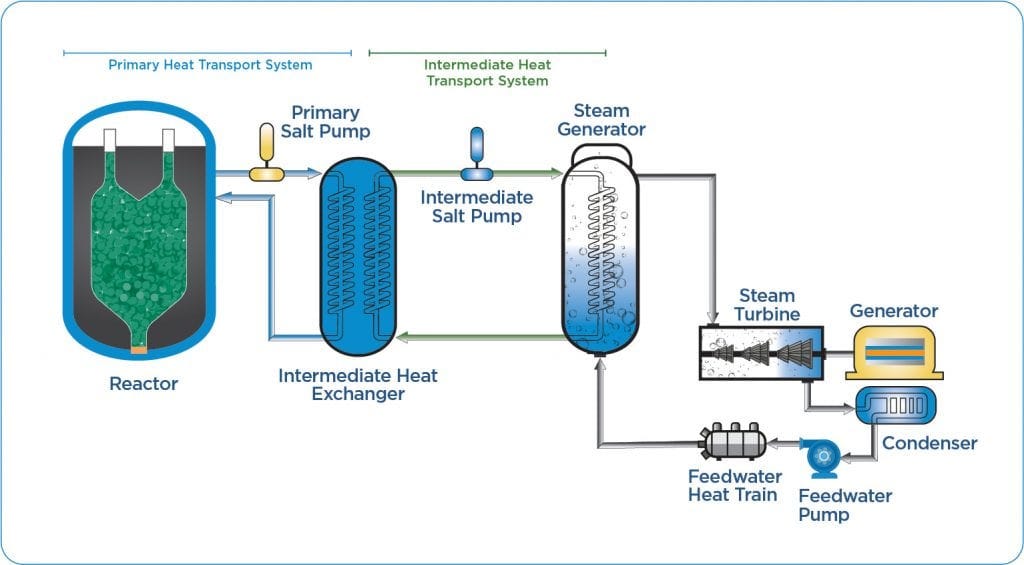

• Technology Context: Kairos’s reactor uses a fluoride salt coolant, enabling high-temperature, low-pressure operation that simplifies containment and potentially lowers costs. The company is vertically integrated, manufacturing the majority of its reactor components in-house.

• Technology: Fluoride High-Temperature Reactor (KP-FHR)

• Coolant: Fluoride Salt

• Output: Test Reactor, 35 MW (thermal), with potential commercial scaling

• Pros:

High-Temperature, Low-Pressure Operation: Fluoride salt enables efficient heat transfer without high pressure.

Inherent Safety: Chemically stable, high-boiling-point fluoride salt enhances safety.

Supply Chain Control: Vertical integration minimizes external dependency, improving cost efficiency.

• Cons:

High Initial Investment: In-house development demands significant upfront costs.

Corrosion Concerns: Fluoride salts can be corrosive, requiring advanced materials.

New Technology Challenges: Limited commercial experience with salt-cooled reactors necessitates further validation.

• Status: Private

• NRC License: Combined License (COL) – Oklo previously failed to obtain NRC approval in 2022 but has since resubmitted its application, which is currently under NRC review.

• Technology Context: Oklo’s reactor design draws inspiration from the EBR-II, a mid-20th-century experimental reactor that pioneered a closed fuel cycle to address potential uranium shortages by “breeding” fuel. While the original EBR-II aimed to recycle fuel, Oklo adapts this concept with a focus on inherent safety, using a fast neutron spectrum and potassium coolant, which operate at low pressure and simplify containment. This design reduces structural complexity and enhances the reactor’s flexibility, making it well-suited for compact, small-scale deployments. Oklo’s reactors target small, decentralized applications, with an emphasis on remote or off-grid locations like isolated communities or industrial sites that require reliable, independent power sources.

• Technology: Compact Fast Reactor, inspired by the Experimental Breeder Reactor II (EBR-II)

• Coolant: Potassium

• Output: ~1.5 MWe, designed for small-scale, remote applications

• Pros:

Compact, Flexible Design: Suited for remote or isolated locations.

Low-Pressure Operation: Potassium coolant allows high-temperature performance without high pressures.

Inherent Safety: The fast neutron spectrum enhances safety, reducing containment complexity.

• Cons:

Efficiency Limitations: The breeder reactor focus prioritizes fuel production, impacting efficiency.

Unfamiliar Coolant: Potassium is less common in nuclear applications, introducing scalability challenges.

Limited Commercial Precedent: Minimal commercial track record requires additional regulatory validation.

• Status: Private

• NRC License: Construction Permit Application Submitted – TerraPower has applied for a Construction Permit for the Natrium reactor, allowing construction but not operation.

• Technology Context: TerraPower’s Natrium reactor combines a sodium fast reactor with molten nitrate salt storage for load-following capabilities, aligning with the variability in renewable energy supply. The sodium coolant enables efficient, low-pressure heat transfer.

• Technology: Sodium Fast Reactor with Molten Salt Thermal Storage

• Coolant: Sodium (primary) with Nitrate Salt (thermal storage)

• Output: 345 MWe with the capacity to boost to 500 MWe for short periods using thermal storage

• Pros:

High-Efficiency, Low-Pressure Operation: Sodium’s properties reduce structural requirements.

Load-Following Capability: Salt storage enables demand-based adjustments, supporting grids with renewables.

Passive Safety: Sodium’s natural cooling properties provide safety during shutdowns.

• Cons:

Design Complexity: Combining sodium and salt systems raises operational challenges.

Sodium Reactivity: Sodium’s reactivity with air and water requires stringent containment.

Technology Risks: Limited testing and specialized supply chains introduce risks for cost and schedule.

6. Challenges with Energy Prices, Regulatory Pushback, and DOE Contracts

Nuclear power plants operate with a unique cost structure compared to other energy sources like natural gas or coal. The majority of nuclear costs are fixed—covering staffing, maintenance, and long-term fuel contracts—meaning that once operational, shutting down a nuclear plant doesn’t yield substantial savings since these expenses are already incurred. In contrast, gas and coal plants face more variable costs tied directly to fuel purchases, allowing them to cut costs by scaling back during periods of low demand.

This fixed-cost model presents both opportunities and risks for nuclear profitability. During high-demand periods, like the current surge driven by AI’s power-intensive requirements, nuclear operators can command higher rates and secure long-term revenue. This makes their fixed-cost structure an advantage, unlike variable-cost models which may struggle to fully capitalize on such favorable conditions. However, this model also makes nuclear plants vulnerable when they can’t consistently cover these expenses, leading to recent closures, like Pilgrim, Diablo Canyon, and Palisades. Without the flexibility to reduce costs in low-demand periods, nuclear operators face significant challenges when market conditions are unfavorable, highlighting the complexities of nuclear plant economics.

Hyperscaler Price Premium for Independent Nuclear Producers: Is It Sustainable?

The recent demand spike from AI-driven data centers has added an unexpected boost for independent nuclear power producers (IPPs) like Constellation Energy. As an IPP, Constellation sets its own rates based on market dynamics and commercial agreements, unlike vertically regulated utilities like Duke Energy or Southern Company, which must abide by public utility commissions and state regulations. Vertically regulated utilities serve local ratepayers under rates determined by state agencies and influenced by local government, keeping power affordable for state residents. IPPs, however, own their assets outright, giving them the flexibility to sell power directly to commercial clients like Microsoft without needing state approval.

Why are hyperscalers paying a premium? This premium reflects both timing needs and carbon-free commitments. Companies like Google, Microsoft, and Amazon face what could be called a “timing and clean-energy premium.” They need nuclear power to cover their immediate, large-scale energy demands while also meeting future growth. This demand gap, or “time mismatch,” makes dedicated, long-term nuclear contracts appealing, especially through “behind-the-meter” agreements. These setups, originally popularized by Bitcoin miners for cost-saving, now enable data centers to bypass transmission fees and secure direct, reliable energy access without regulatory delays. Nuclear plants, with their robust transmission connections, can handle data centers’ massive loads—often hundreds of megawatts—without needing the costly infrastructure buildouts required for other power sources. While coal plants could theoretically offer the same capacity, their environmental impact would undermine tech companies’ decarbonization commitments, making nuclear power the most viable choice. Immediate access, scalable capacity, and alignment with climate pledges justify the premium.

However, this pivot to premium nuclear sales raises public concerns. Many nuclear plants, including newer SMR startups, have historically relied on state and federal subsidies to stay economically viable, with the understanding that this subsidized power would primarily support local and state energy needs. Now, the idea of selling subsidized nuclear megawatts to tech giants has sparked backlash from politicians and advocacy groups: “Why should taxpayer funds support AI data centers over community needs?” It’s a valid question, especially as subsidies like Zero Emission Credits (ZECs) and Production Tax Credits (PTCs) establish a price floor—often around $45 per megawatt-hour—that provides baseline profitability for nuclear operators. Coupled with premium rates from tech firms, reportedly reaching up to $85 per megawatt-hour, nuclear operators can more than double their earnings, amplifying public scrutiny. Yet, a 100%+ premium may not be sustainable if data center demand dips or energy prices fluctuate.

To balance profitability with public accountability, Constellation is exploring “net new” capacity options, like restarting dormant reactors and implementing power uprates, ensuring new generation supports tech demands without cutting into regional energy allocations. This approach maintains the subsidized “baseline” power for local needs while directing additional capacity to data centers. As nuclear power’s commercial role expands, balancing these interests will be essential to fulfilling both private and public energy demands in the evolving energy landscape.

What About Those Large DOE Grants?

In the nuclear energy sector, especially for innovative projects like Kairos Power’s Hermes reactor, a performance-based, fixed-price contract represents a valuable shift from traditional government contracting methods. This contract model, backed by the Department of Energy’s Advanced Reactor Demonstration Program (ARDP), ensures more effective oversight while providing small companies like Kairos with milestone-based funding to support each project phase, such as design, construction, and testing.

What is a Performance-Based, Fixed-Price Contract?

This type of contract is structured around key project milestones. Instead of a blanket funding or reimbursement model, it provides payment only when the company achieves pre-defined goals. The government benefits from greater oversight and accountability throughout the project lifecycle, while the company benefits from steady, incremental funding. If a company fails to meet a milestone, the government can halt further funding and reallocate resources to other promising initiatives. SpaceX has used performance-based, fixed-price contracts extensively. For example, in contracts with NASA—such as the Commercial Crew Program and cargo resupply missions—SpaceX receives funding only upon reaching designated milestones, like successful testing or launch achievements.

Why Not Use Traditional Cost-Plus Contracts?

In traditional cost-plus contracts, vendors receive payment for all costs plus a guaranteed profit margin. This model has been especially common with established contractors, but it is notorious for cost overruns and inefficiency, as there’s little incentive to finish on time or within budget. By contrast, the performance-based approach used with Kairos aligns with specific project milestones and is seen as a more efficient and cost-effective option for managing taxpayer funds, especially when working with smaller, agile firms in high-tech sectors.

Why Not Use Standard Fixed-Price Contracts?

In standard fixed-price contracts, companies receive payment only upon full project completion. However, smaller companies and startups may not have the cash flow to support large projects without phased payments. The performance-based fixed-price model offers a middle ground: payments are made incrementally after completing each milestone, making it feasible for new market entrants while maintaining government oversight.

For Kairos, this structure provides a steady capital flow to achieve its ambitious goals while ensuring DOE accountability in funding advanced nuclear projects with high risks and potential rewards. This phased payment method is tailored to support the innovative yet resource-constrained environment startups often navigate, while also aiming to protect public funds in an industry where cost control is critical.

The Profit Myth of Large Government Contracts

While performance-based, fixed-price contracts help manage costs and keep projects on track, they don’t guarantee profitability for companies like Kairos. This contract structure helps ensure cash flow and milestone funding, but the payments may not fully cover unexpected costs, which are common in high-stakes, innovative fields like nuclear energy. For Kairos, constructing and demonstrating the Hermes reactor involves substantial upfront and unforeseen expenses—materials, labor, testing, and regulatory compliance—that might exceed the pre-set payment amounts tied to each milestone.

Moreover, unlike traditional cost-plus contracts, which cover all project expenses plus a profit margin, a performance-based contract only funds predetermined milestones. This can make it challenging to absorb additional costs if they arise mid-project, potentially leading to budget constraints or project delays. For nuclear startups, where specialized components and advanced materials are essential, fluctuations in supply chain costs or regulatory demands can quickly add to expenses, diminishing the potential for profitability. Thus, while this contract model offers advantages in terms of structure and accountability, it doesn’t necessarily translate to financial gain, especially for projects that are complex, costly, and have long timelines to commercialization.

That’s enough nuclear for this month.