According to The Information, military defense startup Anduril is in early talks to raise around $1.5 billion, valuing the company at $12.5 billion or more. This potential round marks a significant jump from its $8.5 billion valuation a year and a half ago. Anduril has raised over $2 billion and doubled its revenue to about $500 million last year, according to the news.

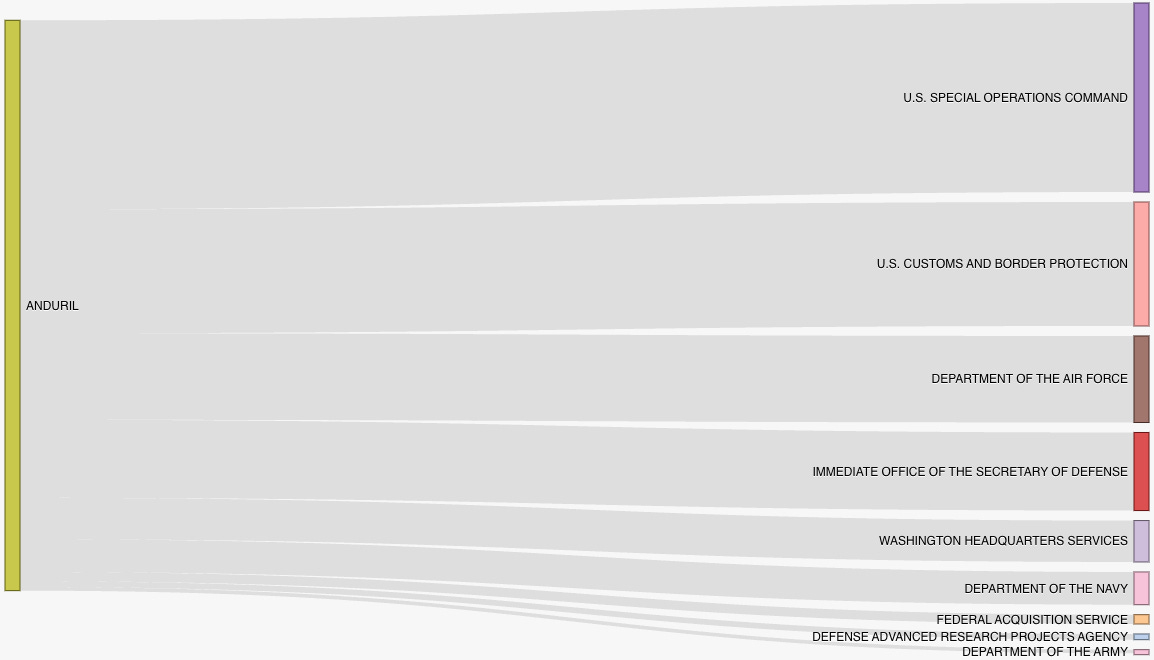

Our aggregated public data and analysis show that Anduril had around $350 million in federal transactions last year, with an additional $300 million in potential federal awards yet to be transacted over the next three years. Bear in mind, certain defense awards are not publicly available. Here's a rundown of the company's major federal subagency customers in 2023 by size and potential federal awards by their expiration dates.

Anduril’s 2023 Federal Customers

Anduril’s Outstanding Award Value by Expiration Year

Anduril’s raise brings to mind Israeli cybersecurity startup Wiz, which recently raised $1 billion at a $12 billion valuation. Wiz is open about its plans to use the funds for M&A efforts, product development, and recruiting new talent, predicting 2024 as "the year of security consolidation." This approach has caught the attention of cyber insiders, who view it as “VC-backed PE behavior.”

Anduril, on the other hand, is quieter about its acquisitions but rather open about announcing awards. Allegedly, the company buys firms that have completed lengthy development processes, integrates their contracting vehicles, and then lands high-profile defense awards. Those firms’ business development and R&D process likely takes 3-5 years on average. Our deep analytics support this hypothesis. We detect each company’s IDIQ vehicle counts, which take years to develop, and quick increases typically reflect growth via acquisition. The growth in Indefinite Delivery, Indefinite Quantity (IDIQ) contracts from 3 to 10 in 3 years hints at this strategy.

To be fair, this approach isn't new in government contracting—it's a common playbook, though Anduril's news release doesn't mention it much. If large DC-focused PE firms or major defense contractors used the same playbook, it would be considered normal. Smaller companies often aim to grow to a size that makes them attractive for acquisition as well, typically around 250 employees, with IDIQ.

We've taken a snapshot of every company’s organizational metrics: Anduril’s headcount grew by 21% in the last six months, with an 18% increase in engineering staff. However, Glassdoor reviews have slipped from 4.3 to 3.9 since the beginning of the year, which isn't uncommon for rapidly growing firms.