How Generative Answers Are Reshaping Google Search

Don’t Worry About Google, Worry About Yourself

This week, headlines buzzed with speculation about Google’s traditional search business - employee buyout and noises proclaiming its core business dominance doomed. Yet, Alphabet’s search empire isn’t collapsing; it’s evolving, probably better than you.

When a traditional Google search result page (SERP) loads, three revenue-generating layers compete for the user’s first scroll: (i) Shopping and text ads, (ii) a knowledge panel/featured snippet, and (iii) the organic blue-link stack. The debut of AI Overviews inserts a full-width narrative block that can consume 500–1200 vertical pixels. Eyetracking studies by Sistrix, Similarweb, and SparkToro show that on screens under 1080px tall, over 70% of users don’t reach the first organic result when an Overview is present. For product-review and recipe queries - the bread-and-butter of affiliate publishers - the click deficit hits 50 - 60%. Google claims publisher engagement is maintained or improved, but independent data shows significant declines in organic click-through rates (CTR) and publisher traffic. Google’s internal “satisfaction” metric (time spent before a long click) may improve, but the supply of billable events in the ad auction shrinks.

Google’s Response: Rewiring Ad Economics

Google counters this shift in three ways that reshape ad economics:

Re-instrumenting impressions. Ads once buried below the fold now appear within AI Overviews as carousels, star-rated merchants, or hotel cards. A viewable impression qualifies for Smart Bidding, even without a click. Under updated Ads Data Hub terms, advertisers can optimize for “engaged-view conversions” (e.g., video or interactive widgets viewed for ≥10 seconds) rather than clicks alone. This effectively tests a CPM/CPV (cost-per-mille/cost-per-view) model within a CPC (cost-per-click) framework.

Promoting first-party commerce. The Shopping Graph powers inline purchasing—Buy on Google, Checkout with Maps, or Hotels meta - that completes within Google Pay. These zero-redirect flows earn a 12 - 15% commission versus a two-digit CPC equivalent in classic Product Listing Ad (PLA) auctions, preserving margin as link-out volume falls.

Performance-Max defaulting. AI Overviews often pull from organic snippets rather than ad headlines, so ads that appear are mostly Performance - Max (P - Max) “asset-less” units. Google constructs the creative, chooses the channel, and sets bid multipliers, expanding the opaque spend pool that accounts for ~25% of search/Shopping revenue.

Auction Math: Why CPCs Rise as Clicks Fall

Average Google CPCs rose ~5% in 2022 and ~3% in 2023, even as impression volume on high-information SERPs fell. This stems from fewer ad slots and higher competition (more advertisers bidding on premium spots). Counterpoint Research simulations show that cutting above-the-fold text ads from four to two, with query intent constant, raises the 80th-percentile CPC by 24% - even if total clicks drop 18%. For Google, higher yield per click offsets lost clicks. For advertisers, return on spend (ROS) holds steady if conversion rates on remaining high-intent queries stay strong.

The flywheel breaks if:

A significant share of commerce searches resolves in-SERP, eliminating downstream purchases that Smart Bidding relies on.

Alternative channels like Amazon’s Sponsored Brands + Buy with Prime or TikTok Shop capture mid-funnel research queries and prove they can close sales.

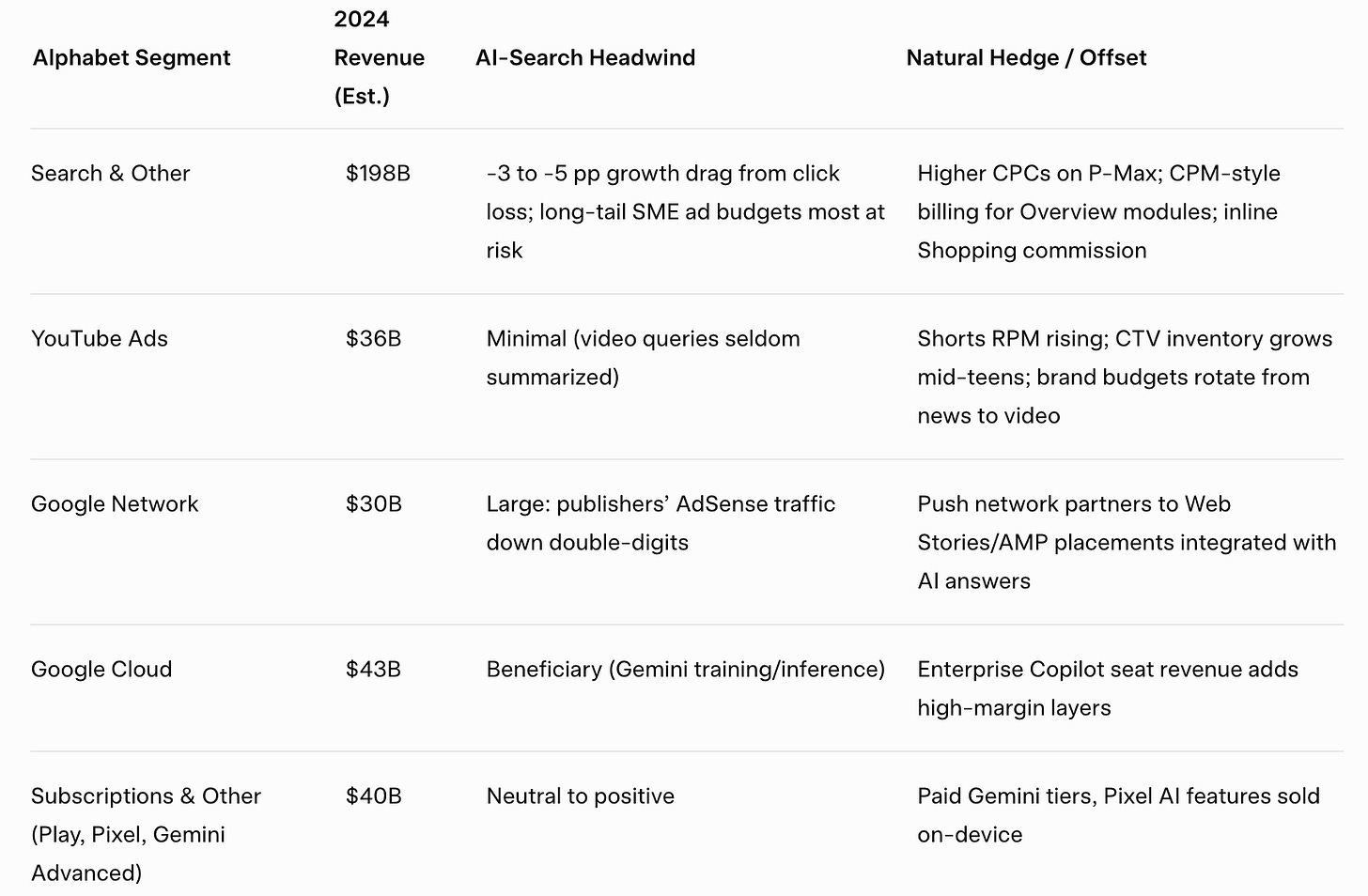

Risks and Offsets by Revenue Line

Even if Search revenue slows to low single-digits, Alphabet’s consolidated growth can stay high single-digits if Cloud and YouTube maintain trajectories and paid Gemini reaches ~20M seats.

Competitive Landscape

Microsoft / Copilot. Switching from Google to Bing is a behavioral, not technical, hurdle. In M365 environments, Copilot leverages SharePoint, Teams, and Outlook data for enterprise-grade retrieval-augmented generation (RAG), which Google can’t match without Workspace migrations. Monetization likely relies on $30 ARPU seat-based fees and B2B SaaS plug-in revenue shares, bypassing classic ad auctions.

Amazon and Retail Media. Amazon’s Sponsored Products generated $46B in ad revenue in 2024, growing ~20% YoY. Agencies report Amazon’s return on ad spend (ROAS) is 2× Google Shopping for CPG and 1.4× for hardlines. Amazon’s Rufus chatbot funnels users to Sponsored Products, tightening its grip on commerce queries where Google’s margins are highest.

TikTok/Meta Short-Video Search. ByteDance’s ad load is under 5%, with room to double revenue without harming UX. Meta Reels, backed by Advantage+ Shopping campaigns, cannibalizes some search retargeting spend.

What Publishers and SEOs Can (and Cannot) Do

Structured Data & In-SERP Brand Presence. Entities like reviews, pricing, and author E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) that feed the Shopping Graph boost chances of appearing in AI Overviews, even without a link. Brand visibility in the panel becomes the KPI, not clicks.

Own the Point of Transaction. Affiliate sites are pivoting to membership clubs, price-tracking tools, or “buy here” API integrations to capture conversions before Google intermediates.

License Archives. Large publishers are securing $5–20M annual deals to license corpora to OpenAI, Anthropic, or Google’s DeepMind, bypassing unreliable attribution traffic.

These tactics don’t fully replace free referral flow. Most small publishers won’t survive, and consolidation is inevitable. Action: Start testing structured data today to maximize in-SERP visibility.

The Road Ahead

Google’s Model Bends, Not Breaks.

AI Overviews siphon low-value clicks (e.g., “What day is Memorial Day?”) that never monetized well. By collapsing four ad slots into two Overview-ad carousels, Google turns scarcity into pricing power. Agencies report 3–5% annual CPC inflation as clicks ride higher-intent queries and Performance Max bundles that advertisers cannot un-bundle. Google also pulls shopping discovery in-house—Buy on Google, Maps bookings, hotel meta—earning 12–15% take-rates versus $1.20 PLA clicks. Revenue shifts from many cheap redirects to fewer, richer engagements—a bend, not a break.First-Order Pain Lands on Publishers.

Specialist sites for “best cordless drill 2025” are summarized in AI paragraphs. Similarweb shows lifestyle and recipe blogs down 40–60% YoY in Google referrals, large newsrooms off high-teens, and the Daily Mail reporting a 44% hit. Lost sessions vaporize AdSense impressions, critical for the $33B Google Network. SEO agencies describe a “cesspool” of collapsing mid-tail sites, urging clients to build walled-garden newsletters or license archives to model builders.The Advertiser “Visibility Tax.”

With two ad slots instead of four, brands face a Hobson’s choice: bid higher in opaque Smart Bidding pools or vanish below the fold. Advertisers distrust Google’s opacity but pay to avoid ceding real estate to rivals. CPCs rose ~5% in 2022 and ~3% in 2023 despite fewer clicks. Until TikTok Shop, Amazon, or a post-cookie retail-media graph prove equal closed-loop ROAS, brands will swallow this surcharge.Agentic AI: The Bypass Threat.

ChatGPT and Gemini answer questions; Copilot-style agents complete tasks. If an Outlook sidebar books a roofer or reorders supplies without touching the web, Google and Amazon lose demand generation. Microsoft’s enterprise RAG advantage—Copilot’s access to SharePoint, Teams, and ERP context—outpaces Google. Alphabet’s counters include:Gemini Nano on Android, shipping a Google-controlled agent.

Wallet-native checkout for one-click sales in Assistant or Maps.

Voice Commerce pilots for in-dialogue payments, keeping the agent in-house.

What the Market Watches.

Analysts have trimmed their growth expectations for Google Search to a mid-single-digit CAGR, but still maintain high price targets for Alphabet—thanks to three key growth engines:

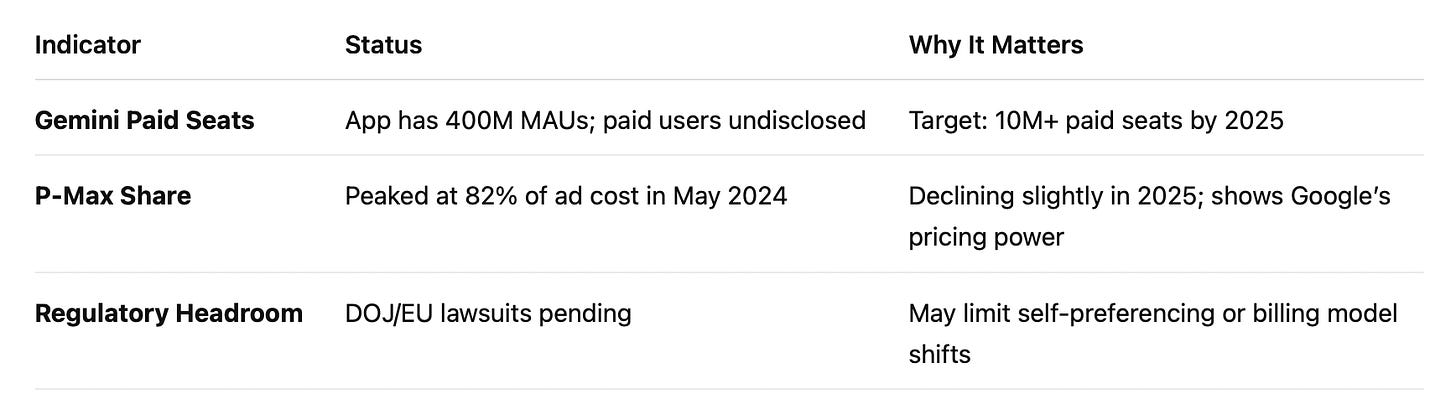

Leading Indicators:

Gemini Paid Seat Growth: Gemini’s app has 400M monthly active users, but paid “Advanced” seats are undisclosed. 10M seats by 2025 is plausible but speculative.

Performance Max Share: P-Max peaked at 82% of Google Ads cost in May 2024, slightly declining in 2025 as advertisers test “Search Max” formats. High share shows Google’s repricing power.

Regulatory Headroom: EU and DOJ cases could restrict Google’s self-preferencing or CPM/engaged-view billing shift. A narrow settlement preserves flexibility.

Generative search rewrites discovery’s physics, but Google still captures the sun. It trades click volume for yield, pivoting cash flow to Cloud, YouTube, and subscriptions while publishers wither. If agentic AI reroutes demand, the battle shifts to who owns the device and wallet—Gemini on Android, Copilot in Office, or a new contender. Until then, advertisers pay the visibility tax, publishers endure the traffic drought, and Alphabet—though dented—remains the toll collector.